Introduction

Earned Wage Access Apps Loans, In today’s rapid-paced world, watching for a bi-weekly paycheck doesn’t always align with actual-life charges. Whether it’s a scientific emergency, automobile restore, or software invoice, humans frequently want access to their earned wages before payday. This is wherein earned salary get admission to apps and loans step in.

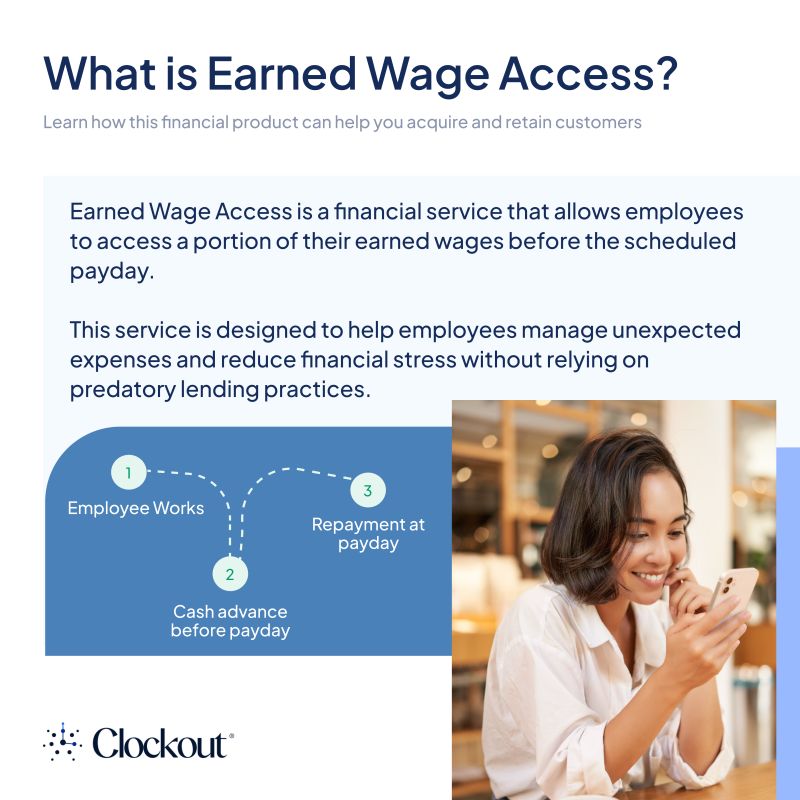

Earned salary get entry to (EWA) lets in employees to get admission to a element in their earned income before the authentic payday—without turning to high-hobby payday loans. EWA isn’t a loan in the traditional feel but acts greater like a profits boost, and it’s gaining reputation speedy.

How Earned Wage Access Apps Work

These apps hyperlink without delay together with your organisation or time-monitoring device. Based totally at the hours you’ve already worked, they calculate how a whole lot you may get admission to early.

Key Steps:

- Hook up with enterprise/payroll system through the app.

- Tune earned hours the use of integrated software.

- Request early fee—generally via the app’s dashboard.

- Receive funds—right away or inside 1 commercial enterprise day.

- Stability automobile-deducted on payday out of your income.

Benefits of Earned Wage Access Apps

- Keep away from excessive-hobby Payday Loans

- No credit test

- Instantaneous get admission to to Wages

- More monetary manage

- Higher Budgeting options

- Stepped forward employee delight (for organizations)

Drawbacks to Consider

Whilst EWA apps offer convenience, they’re now not perfect. Here are a few dangers:

- Routine Dependence – can also end up a addiction if used too regularly.

- Confined get right of entry to – typically simplest part of your wages are on hand.

- Fees add Up – although small, costs per transaction can gather.

- Now not to be had for All Employers – Many apps need agency participation.

Who Should Use Earned Wage Access?

EWA apps are pleasant for:

- Employees living paycheck to paycheck

- Hourly people with irregular shifts

- Gig financial system people

- Those dealing with emergency prices

- Humans looking to avoid credit-based loans

But, it’s no longer an extended-time period answer for continual financial instability.

How to Choose the Right Earned Wage Access App

While selecting an EWA app, recollect:

- Does it require company participation?

- Are the prices obvious and inexpensive?

- How quickly can you get budget?

- Is it available to your employment kind (gig, full-time, and so on.)?

- Are there different financial gear provided (budgeting, alerts, financial savings)?

How to Get Started with an EWA App

Right here’s a preferred guide to the use of an earned salary get admission to app:

Step-by-Step Setup

- Download your chosen EWA app (e.g., EarnIn, Dave, Payactiv).

- Create an account using your email and phone number.

- Join your bank account and provide employment information.

- Verify your paintings agenda or direct deposit.

- Request get right of entry to to earned wages based on the quantity shown.

- Receive the development for your bank account or prepaid card.

- Payback is automatic on your payday.

Tips for Responsible Use

To keep away from misuse of EWA offerings, observe these first-class practices:

- Set a month-to-month utilization limit.

- Use for genuine emergencies simplest.

- Integrate with a budgeting app.

- Keep away from relying on EWA each pay cycle.

- Pick out apps that offer free or low-fee transactions.

Employers and Earned Wage Access

Companies that provide earned salary get admission to as a advantage see numerous advantages:

- Increased employee retention

- Better process satisfaction

- Decreased absenteeism

- No principal fee to the organisation (apps cope with most of it)

Apps like DailyPay and Payactiv combine directly with enterprise payroll structures, making it less complicated to put into effect.

FAQs

Q1. Are earned wage access apps loans?

No, EWA apps are not conventional loans. They give you get right of entry to to cash you’ve already earned, with minimum to no hobby.

Q2. Do EWA apps affect my credit score?

Most do no longer. On account that there’s no credit score take a look at or reporting, your credit rating stays unaffected.

Q3. What if I switch jobs or miss work?

In case you don’t earn sufficient or alternate employers, you could no longer be eligible for in addition advances. The repayment is paused or canceled primarily based at the app’s terms.

Q4. Are these apps safe to use?

Sure, most main EWA apps use encryption and comply with financial rules. Usually check critiques and regulations before the use of one.

Q5. Can I use multiple EWA apps?

Technically, sure. However, it’s now not recommended as it could cause confusion and potential overuse of your wages.

Conclusion

Earned wage access apps and loans are converting the manner people manipulate their personal price range. They provide instant monetary relief with out the traps of payday lending. By using supplying safe, quick, and bendy get admission to to earned wages, those apps empower customers to take higher manage in their cash.

However keep in mind: EWA need to be used as a tool—no longer a crutch. economic training, budgeting, and responsible usage move hand in hand with those apps. Select accurately, examine the terms, and usually plan in advance.