Exploring the universe of Apple Student Loans can want to attempt to track down your direction through a thick haze. Before you acquire from Apple Understudy Loans, it’s essential to comprehend a few vital viewpoints to settle on informed choices. You’ll have to deal with your advances persistently, make ideal installments, and keep in touch with your credit servicer. Looking at financing costs, including APRs and charges, guarantees you won’t pay more than needed after some time. Meeting qualification measures and investigating different reimbursement plans can extraordinarily influence your monetary future. Yet, what might be said about the secret expenses and expected traps? We should investigate further.

Key Features Apple Student Loans

While considering Apple Understudy Loans, it’s essential to comprehend their vital elements to pursue an educated choice. To start with, we should discuss borrower obligations. As a borrower, you’ll have to determinedly deal with your credit. This incorporates making opportune installments, monitoring your reimbursement plan, and keeping in touch with your credit servicer. Satisfying these obligations is fundamental to keeping a decent FICO rating and keeping away from punishments or extra expenses.

Then, focus on the credit terms. Apple Understudy Loans ordinarily offer adaptable reimbursement choices, which can be custom-made to your monetary circumstance. You could have the decision between standard, graduated, or pay driven reimbursement plans. It’s essential to audit these choices and select the one that adjusts best to your future monetary standpoint.

Furthermore, know about the advance length and any related expenses that could apply.

Understanding these key highlights assists you with exploring the getting system all the more successfully. By remaining informed about your borrower obligations and cautiously taking into account the credit terms, you can make a brilliant, sure choice with respect to your Apple Understudy Loan. Along these lines, you’ll be more ready to deal with your funds during and after your schooling.

Interest Rates

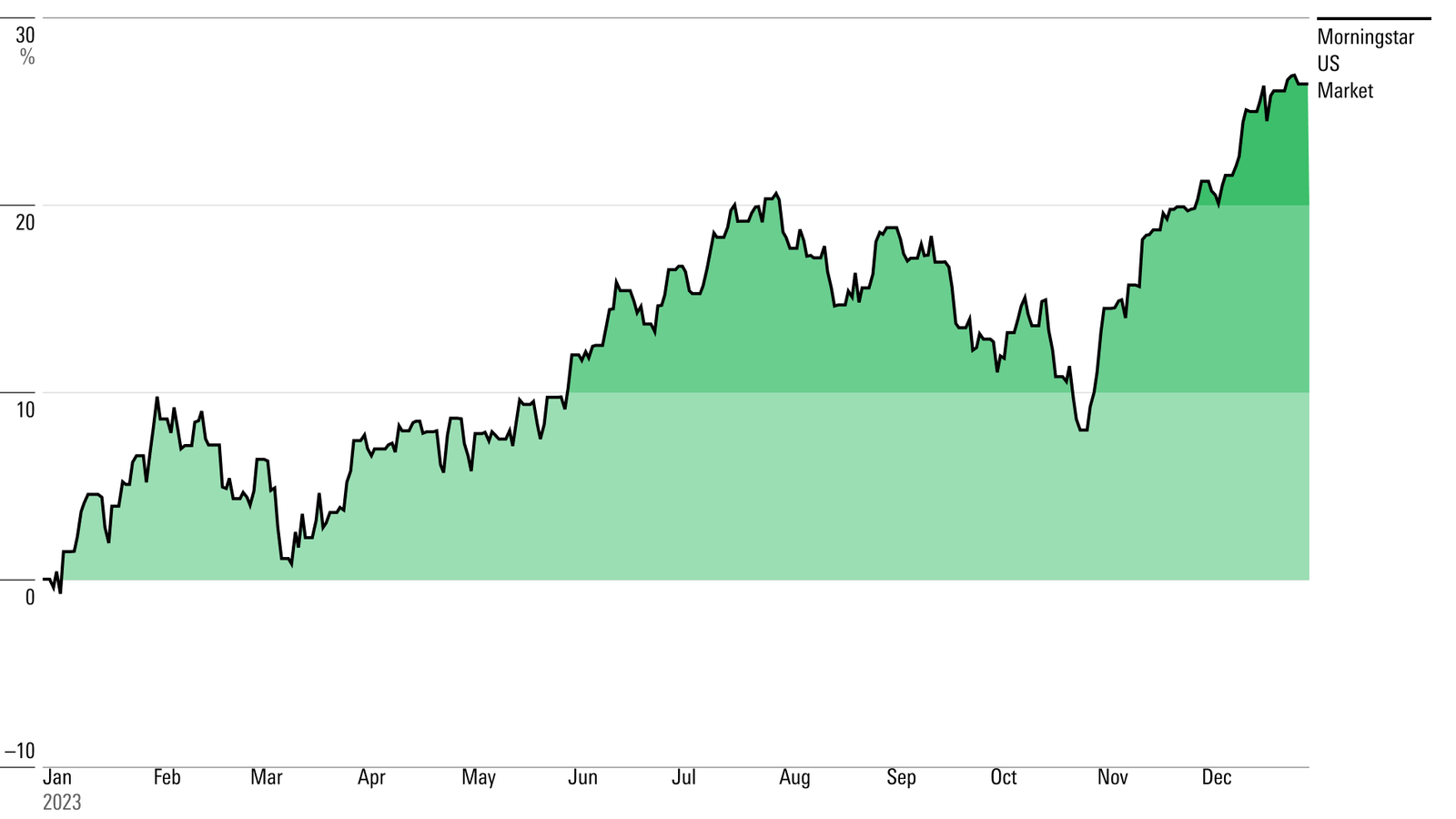

While understanding borrower obligations and advance terms is significant, accepting the idea of financing costs is similarly fundamental. Financing costs straightforwardly influence the aggregate sum you’ll reimburse over the existence of your understudy loan. While looking at rates, you want to consider both the yearly rate (APR) and any extra charges that could apply.

Apple Understudy Loans offer serious rates, however it’s urgent to do some examination shopping. By looking at rates from different banks, you’ll get a more clear image of what’s accessible and can settle on an educated choice. Remember that a lower financing cost implies you’ll pay less over the long haul, so it’s definitely worth the work to search around.

Understanding terms is another key perspective. Fixed financing costs continue as before all through the credit term, giving strength in your regularly scheduled installments.

Variable rates, then again, can vary in view of economic situations, which could bring about higher installments down the line. Realizing the distinction will assist you with picking the most ideal choice for your monetary circumstance.

Eligibility Criteria

Exploring the qualification rules for Apple Understudy Loans is fundamental to decide whether you qualify. In the first place, you’ll have to meet explicit pay prerequisites. While Apple doesn’t request a big league salary, they truly do anticipate that you should exhibit the capacity to reimburse the credit, which could incorporate proof of any temporary work or different types of revenue.

Your scholarly standing is likewise a basic element. Apple normally expects you to keep a specific GPA, as a rule around 2.5 or higher, to guarantee you’re gaining palatable headway in your examinations. This guarantees that the credit is going to understudies who don’t mess around with their schooling.

On the off chance that your financial record areas of strength for isn’t, stress. Apple offers cosigner choices that can assist you with getting the advance. A cosigner with a superior record can essentially work on your possibilities of endorsement and may try and get you a superior loan cost.

It’s a strong method for building your credit while as yet getting the monetary help you want.

Application Process

Applying for Apple Understudy Loans is a direct cycle intended to be essentially as easy to understand as could really be expected. To start with, you’ll have to visit the Apple Understudy Loans site and make a record. Once signed in, you’ll be directed through a progression of moves toward complete your application.

You’ll begin by giving individual data, including your name, address, and Government managed retirement number. Apple will then direct a credit check to survey your reliability. Relax in the event that your record is flawed; Apple Understudy Loans are planned in light of understudies, so the credit necessities are much of the time more permissive contrasted with customary advances.

Then, you’ll have to determine your ideal advance sum and audit the credit terms. This incorporates understanding the loan cost, reimbursement plan, and any related expenses. Ensure you read the credit terms cautiously to guarantee you’re alright with the monetary responsibility you’re making.

In the wake of assessing and consenting to the terms, you’ll present your application. Apple commonly gives a reaction inside a couple of work days. Whenever endorsed, the assets will be dispensed straightforwardly to your school, permitting you to zero in on your schooling without monetary pressure.

Repayment Plans

When your application is endorsed and the assets are dispensed, it’s essential to comprehend the accessible reimbursement plans for Apple Understudy Loans. You’ll experience a few choices intended to fit different monetary circumstances and objectives.

To begin with, Apple offers pay based plans that tailor your regularly scheduled installments as indicated by your income. These plans guarantee that your installments stay sensible, regardless of whether your pay vacillates. They’re particularly helpful in the event that you’re entering a field with variable pay potential. By covering your installments at a level of your pay, you will not be overpowered by huge month to month charges.

Furthermore, Apple Understudy Loans accompany open doors for credit absolution. On the off chance that you work in specific public help occupations or meet other explicit measures, you could fit the bill for fractional or complete credit pardoning after a set number of installments. This can fundamentally decrease the aggregate sum you’ll have to reimburse over the long haul.

Understanding these reimbursement choices can assist you with dealing with your obligation really and stay away from monetary pressure. Try to study each and every available plan and get the one that best lines with your financial situation and calling targets. Thusly, you can focus in on your assessments and future calling without steady worry about your development repayment.

Potential Pitfalls

While considering Apple Understudy Loans, it’s critical to know about potential entanglements that could affect your monetary future. One main pressing issue is covered up charges. These can add up rapidly and surprise you, expanding your general obligation. Try to peruse the fine print and completely see any extra expenses related with your credit. Make sure to questions and look for explanation on anything that is not satisfactory.

Another significant variable is credit checks. Apple Understudy Loans might require a credit check to decide your qualification and financing cost. On the off chance that you have a low FICO assessment, you could confront higher financing costs, making your credit more costly over the long haul. Prior to applying, check your credit report and work on working on your score if vital.

Also, be aware of the advance terms. A few credits might’ve severe reimbursement plans that don’t offer a lot of adaptability. Assuming you miss an installment, you could have to deal with damages that further strain your funds. Continuously consider your capacity to meet the reimbursement necessities prior to committing.

Conclusion

Before you acquire from Apple Understudy Loans, make sure to deal with your advances tirelessly and make ideal installments. Look at financing costs cautiously — a 1% contrast in APR can save you thousands over the credit term. Ensure you meet the qualification models and investigate pay based reimbursement choices. Pick a reimbursement plan that accommodates what is happening and profession objectives to keep away from pressure. Remain educated and proactive to really deal with your understudy obligation.