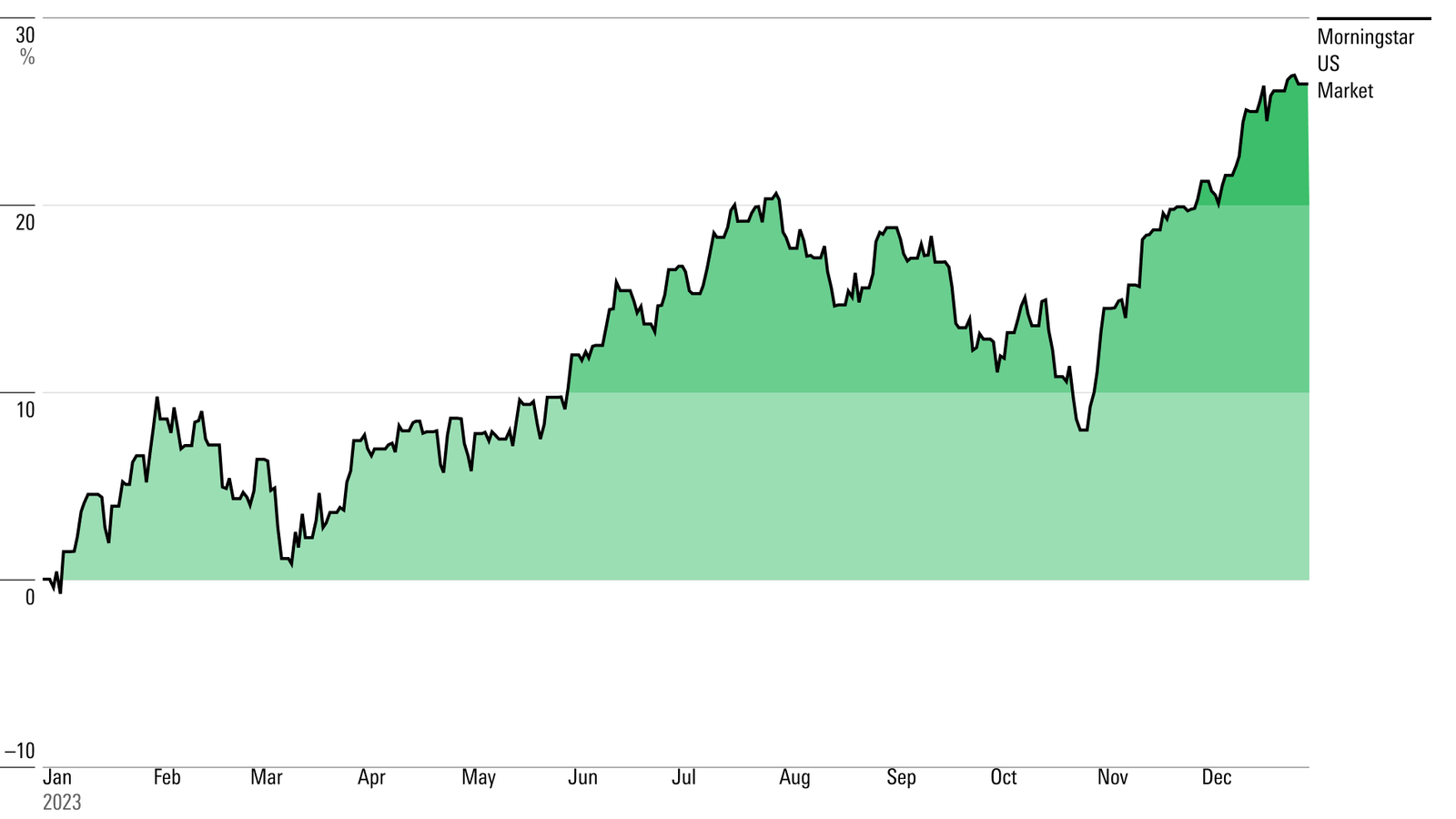

The Stock Market Performance is a vital part of the worldwide monetary gadget. It provides individuals, organizations, and governments the possibility to shop for and sell ownership in publicly traded agencies. Inventory marketplace overall performance is important for investors, analysts, and economists to decide the monetary health of a state. In this article, we are able to explore the idea of stock market overall performance, the elements that affect it, how to degree it, and suggestions to navigate the ever-converting panorama.

What is Stock Market Performance?

Stock market performance refers to the general health and pastime of the inventory marketplace. It’s a measure of ways nicely the market is doing in terms of rate motion, buying and selling extent, and average boom. Buyers use this performance to evaluate the capability for profits or losses in the market.

Key Indicators of Stock Market Performance:

- Stock Indexes: A stock index (just like the S&P 500, Dow Jones, or Nasdaq) tracks the performance of a group of stocks. A upward thrust or fall in those indexes can imply how the market is acting normal.

- Marketplace Capitalization: The overall cost of a organisation’s high-quality stocks can imply investor self assurance. A big marketplace cap typically shows stability.

- Stock prices: The trade within the prices of individual stocks can also be a very good indicator of market performance.

Factors Affecting Stock Market Performance

Knowledge what drives stock marketplace performance is essential for traders. under are some of the foremost factors that impact market overall performance:

1. Economic Data and Reports

Monetary reviews such as GDP boom, unemployment prices, inflation, and client confidence play a giant role in influencing inventory expenses. Nice monetary reviews can force inventory charges up, while poor reviews frequently reason stock expenses to fall.

2. Interest Rates

Vital banks set interest charges that have an effect on borrowing costs. Decrease hobby quotes can encourage commercial enterprise investments and purchaser spending, main to wonderful stock market performance. In evaluation, better quotes generally tend to gradual down financial growth, affecting stock prices negatively.

3. Corporate Earnings

A organization’s income overall performance is without delay tied to its stock fee. sturdy income reviews often result in a rise in inventory charges, while disappointing effects can cause stock fees to drop.

4. Geopolitical Events

Political instability, wars, or changes in government rules can lead to uncertainty inside the markets. Geopolitical occasions can affect investor sentiment and have an effect on the inventory market’s overall performance.

5. Market Sentiment

Stock marketplace performance is often influenced by means of investor sentiment and psychology. Fantastic news can create bullish sentiment (optimistic outlook), at the same time as poor news might also create bearish sentiment (pessimistic outlook), impacting the marketplace’s route.

6. Technological Advancements

Innovation and improvements in generation can raise stock marketplace overall performance. As an example, the upward push of tech groups like Apple, Microsoft, and Google has drastically driven the marketplace in current many years.

How to Measure Stock Market Performance?

To assess the inventory market’s overall performance, analysts use numerous equipment and metrics. A number of the maximum common include:

1. Moving Averages

A shifting common smooths out brief-term fluctuations in inventory charges to reveal the overall trend over a specific length. commonplace sorts include the 50-day and two hundred-day transferring averages.

2. Price-to-Earnings (P/E) Ratio

The P/E ratio compares a enterprise’s modern share rate to its earnings consistent with percentage (EPS). It is a famous metric to assess whether a stock is undervalued or puffed up relative to its profits.

3. Market Breadth

Market breadth refers to the quantity of shares advancing relative to the ones declining. A sturdy market generally has more advancing stocks than declining ones, displaying broad market participation.

5. Volume Analysis

Inventory market quantity refers back to the variety of stocks traded. Excessive trading extent often shows investor confidence, even as low extent might also sign uncertainty or loss of hobby in a selected inventory or marketplace.

Tips for Evaluating Stock Market Performance

Even as the stock market can be unstable, there are numerous strategies to assist traders evaluate its performance:

1. Focus on Long-Term Trends

Maintain an eye on market-moving information consisting of corporate profits reports, international occasions, and technological improvements. Being knowledgeable will assist you anticipate modifications in inventory market performance.

2. Diversify Your Portfolio

The inventory marketplace tends to reveal long-term growth in spite of short-term volatility. examine overall performance over years in preference to weeks or months to get a clearer photo of the market’s fitness.

3. Understand Economic Indicators

Diversification reduces hazard by means of spreading investments throughout distinctive sectors, industries, and geographical regions. This method facilitates guard buyers from unexpected market downturns.

4. Stay Updated on News and Trends

Take note of monetary reviews and interest rate adjustments. Understanding how these factors have an effect on marketplace overall performance will assist you make greater knowledgeable funding selections.

FAQs About Stock Market Performance

Q1: What is a superb inventory marketplace overall performance?

An amazing stock marketplace performance typically refers to steady growth in stock indexes, with high-quality returns over an extended duration. Effective market performance is regularly connected to economic increase, low-hobby costs, and investor self assurance.

Q2: How does the stock market impact the economic system?

The stock marketplace reflects the monetary health of a country. When stock charges upward thrust, it indicates nice investor sentiment and enterprise increase. However, sharp declines might also suggest monetary slowdown or recession worries.

Q3: Ought to I make investments at some point of a market downturn?

investing at some point of a downturn can be an opportunity to shop for shares at decrease fees, however it comes with dangers. it is crucial to have a long-time period investment strategy and to diversify your portfolio.

How do inventory market crashes affect overall performance?

Stock marketplace crashes usually cause short-time period declines in stock costs.But, markets have a tendency to get better over the years, specifically if the downturn is pushed by means of brief elements like a financial disaster or geopolitical instability.

Conclusion

Inventory marketplace performance plays a important position in shaping the financial panorama. Whether you’re an skilled investor or just beginning, information a way to examine marketplace overall performance is key to creating informed selections. Maintain in mind the various elements that have an effect on the marketplace, use reliable metrics to evaluate overall performance, and remember the fact that diversification and long-term questioning let you navigate volatility.